纽约时报中文网 - 英文原版-英Another Chinese Property Giant Faces a Creditor Who Wants It Dismantled

February 29, 2024 2 min 300 words

这篇报道再次突显了中国房地产行业面临的巨大挑战。另一家中国房企面临债务危机,面临债权人的追讨,令人不禁思考整个行业的可持续性。这不仅是单一企业的问题,更是中国房地产泡沫的一个缩影。政府需要审慎应对,以避免系统性风险。此外,这也是监管机构在房地产市场管控方面亟需加强的明证。中国经济的稳健发展需要结构性改革,而不仅仅是对短期风险的临时救助。这一问题的解决将对中国整体经济健康产生深远影响,需要各方共同努力,以建立更为稳健和透明的房地产市场。

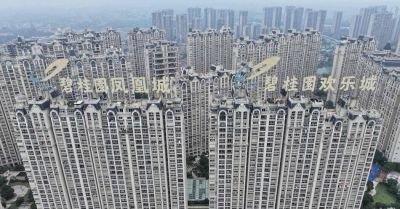

Country Garden, China’s largest real estate developer as recently as 2022, said on Wednesday that a creditor had asked a Hong Kong court to liquidate its operations and pay off lenders, in the latest sign that China’s housing crisis continues unabated.

Ever Credit, a Hong Kong lender, is petitioning the city’s High Court to shut down Country Garden. The court filing involves Country Garden’s failure to repay a loan of $204 million plus interest owed to Ever Credit, the real estate developer told the Hong Kong stock market.

Ever Credit’s petition, known as a winding-up petition, is meant to force Country Garden to close its doors and sell its assets to make money it can use to pay back its creditors. The move followed a High Court order last month for the liquidation of China Evergrande. Country Garden dethroned Evergrande as China’s largest developer in 2021 when Evergrande endured a financial collapse.

Country Garden said that it would fight the court petition “vigorously,” and that the first hearing on the petition had been scheduled for May 17.

More than 50 Chinese property developers have defaulted on debts since 2021. They have refused to repay overseas creditors while still making arrangements with Chinese banks for possible eventual repayment.

Many of these developers have shares listed on the Hong Kong stock market or have borrowed there, or both. But creditors face formidable obstacles in seeking to recover loans from Chinese real estate developers through petitions to the court system in Hong Kong, said Zerlina Zeng, the head of East Asia corporate credits at CreditSights, a global credit research firm.