The Guardian-Embattled China property giant Country Garden faces liquidation petition

February 28, 2024 3 min 480 words

乡村花园遭遇非偿贷款被提起清算诉讼,令其股价早盘下跌超过12%。这不仅对于中国房地产行业的流动性危机是雪上加霜,也再次引发了购房者和债权人对中国房地产部门的担忧。这一事件发生在中国正努力增强房地产行业信心的时刻,该行业占中国GDP四分之一。自2021年以来,中国的房地产行业由于监管打击债务驱动的建设而触发流动性危机,一系列开发商未能履行偿还义务,许多已启动或正进行债务重组以避免破产或清算程序。乡村花园表示将坚决反对清算诉请,但其债务重组过程将受到清算诉请的阴影。这一事件凸显了中国房地产业当前的不稳定局势,需要政府采取果断措施以稳定市场信心。

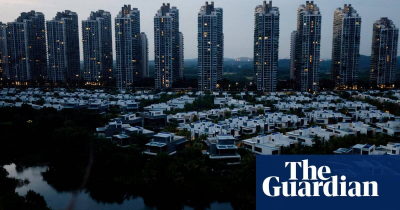

Country Garden Holdings has said a liquidation petition has been filed against the property developer for non-payment of a loan worth $205m, adding to the woes for China’s liquidity crisis-hit property sector.

Country Garden said in a regulatory filing to the Hong Kong Stock Exchange it would “resolutely” oppose the petition, which was filed by a creditor, Ever Credit Limited, a unit of Kingboard Holdings. A court hearing has been set for 17 May.

Country Garden’s shares fell more than 12% in early trading on Wednesday.

The petition is set to revive homebuyer and creditor concerns about the Chinese property sector’s debt crisis, at a time when Beijing is ramping up efforts to boost confidence in the industry that accounts for a quarter of China’s GDP.

It comes a month after China Evergrande Group, the world’s most indebted property developer with $300bn in liabilities, was ordered to be liquidated by a Hong Kong court. It now faces a complicated restructuring process that some investors think could last more than a decade.

China’s property industry, a pillar of the world’s second-largest economy, has lurched from one crisis to another since 2021 after a regulatory crackdown on debt-fuelled construction triggered a liquidity squeeze.

A string of developers have defaulted on their repayment obligations since then, and many of them have either launched or are in the process of starting debt restructuring processes to avoid facing bankruptcy or liquidation proceedings.

Country Garden said it would continue to “proactively communicate and work with its offshore creditors on its restructuring plan” as it aimed to announce terms to the market as soon as practicable.

Country Garden’s debt restructuring process, which gathered momentum in recent weeks, is set to be clouded by the liquidation petition.

“The radical actions of a single creditor will not have a significant impact on our company’s guaranteed delivery of buildings, normal operations and the overall restructuring of overseas debts,” Country Garden said in statement to the Reuters news agency.

Investment holding company Kingboard in October became one of the first known listed companies to take legal action against Country Garden when its unit Ever Credit, which is owed HK$1.6bn ($204m), issued a statutory demand seeking repayment.

Country Garden has appointed KPMG and law firm Sidley Austin as advisers to examine its capital structure and liquidity position and formulate what it called a “holistic” solution.

The company in October missed a $15m bond coupon repayment and so-called ad hoc bondholder groups were formed consisting of international and fund manager investors.

“Country Garden has taken way too long, messing around with switching advisers and wasting time, so it’s no surprise people lose their patience and would rather liquidate them,” a Country Garden dollar bond investor told Reuters.